The rise and rise of the corporate PPA

We have been advising clients on entering into renewable energy power purchase agreements (PPAs) directly with generators since 2008. In 2009 when we published our first briefing on these novel corporate PPA arrangements, the industry referred to them as "direct PPAs" – but corporate PPAs seems to be the name that has stuck.

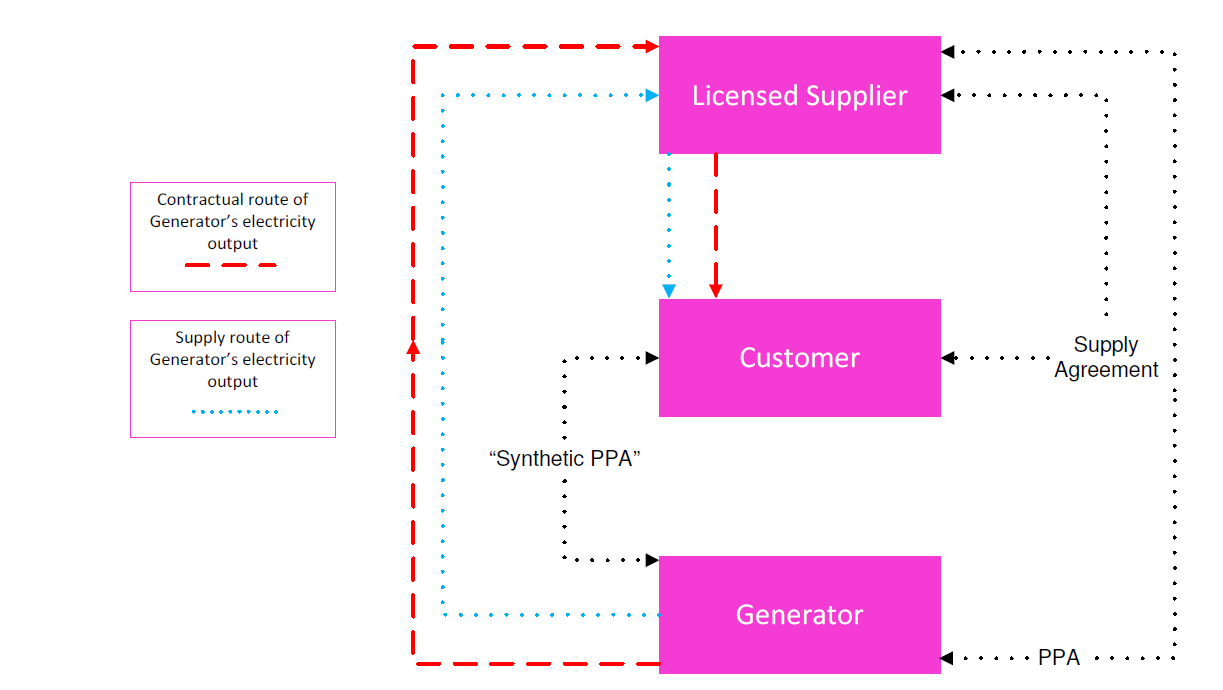

There are a number of approaches that can be taken in structuring corporate PPAs. In this update we're considering the benefits of using the more streamlined synthetic PPA approach, rather than the back-to-back corporate PPA (see our Direct PPA briefing for more details on this model).

In the UK market, the synthetic PPA approach was championed by early adopter Marks & Spencer plc. Its multi-award winning "Price Guarantee Agreement" was a relatively simple form of contract for difference that was rolled out on over 20 projects. However, up to now in the UK market there appears to have been more interest in back-to-back corporate PPAs despite their undoubted additional complexity. It is surprising that the synthetic PPA is not used more widely and certainly when we drafted the template in 2009 we were expecting that corporates would be attracted to this more simple approach.

Market Developments – a perfect storm?

Many early adopters of corporate PPAs in the UK market were spurred on by a pathfinding approach to environmental corporate social responsibility and the sophistication of their approach to electricity procurement. Generators found the opportunity for initially higher (albeit often fixed) long term prices supported by a robust corporate covenant to be an attractive and bankable source of project revenues.

However, the UK energy market has also been through big changes over the last decade resulting in many more corporates catching up with those early adopters.

There have been (and continue to be) unpredictable wholesale price movements as a result of both domestic and wider global economic factors. At the same time, energy users are having to become accustomed to managing their businesses in an environment of rising third party charges. These charges are the result of the socialisation of the costs of delivering the UK's energy market reform programme, changes to grid charging methodologies and the delivery of the UK's renewable energy policy.

As a result many corporates have been looking for ways of achieving longer term certainty over any elements of their energy supply costs. In turn this has led to a massive growth in interest corporate PPAs from generators, funders, energy users and their advisors.

The perfect storm? Factors driving corporate PPA growth:

- Despite lower wholesale prices, the delivered cost of energy has been on the increase due to the rise in third party charges.

- Corporates looking at ways of getting greater transparency and long term certainty over all elements of their energy supply costs.

- Faced with interest from their customers and in an ever competitive I&C supply market, licensed suppliers have responded to customer pressure with innovation – participating in sleeving arrangements and actively offering supply contracts which will allow the sleeving of power (or power prices) procured through corporate PPA contractual structures.

- Increased pressures from investors, consumers, competitors and from within corporates themselves to buy green, promote renewable energy generation and "green" their supply chain.

- Lower wholesale prices (and the expectation of market beating long term prices from generators) have encouraged generators seek out credit worthy corporates for long term PPA tie ups to improve long term wholesale power price certainty. One driver in existing projects is shareholder concern over lower than modelled wholesale prices and the need to deliver more attractive/certain revenue stream for funders/investors in new projects.

Structuring

The back-to-back corporate PPA will be structured as a pass through by the corporate of the terms on which the generator will sell and the licensed supplier will purchase the output of the generating station in question. So, in addition to any requirements of the corporate, it will need to deal with all of the regulatory matters and project specific concerns of the generator and the licensed supplier as well as the complex risk allocations between those parties. Corporates can find themselves caught up in negotiations they have little real interest in, while trying to ensure that they are not left to manage any residual generator or licensed supplier risks.

Synthetic PPAs (or Price Guarantee Agreements or CfDs)

So called "synthetic PPAs" can deliver a direct contractual relationship but allow the Corporate to concentrate only on its key issues (eg price, transfer of renewable certification, key plant maintenance, maximising generation, provision of information). In addition, there is always the ability to "piggy back" on any of the provisions within the export PPA agreed between the generator and licensed supplier which are important to the corporate. With a synthetic PPA, the technical and regulatory details, project specific issues and complex risk allocation arrangements which can characterise offtake PPA negotiations are left to those whose business it is – the generator and licensed supplier. While the regulatory and accounting treatment of a synthetic PPA does need to be considered, it can be significantly simpler and more cost effective documents to negotiate – and are more easily scalable where there are a number of different generators to be contracted with.

It is appreciated that a number of factors can drive the use of the back-to-back structure – such as a corporate's wish for a direct contractual right to purchase power from an identifiable generating station. However, using a synthetic PPA in combination with properly drafted supply contract provisions can significantly reduce the need for the corporate to be involved in complex, time-consuming (and costly) PPA negotiations with both the generator and the licensed supplier. A synthetic PPA can also dramatically reduce the contract value (from an approvals perspective) where the obligation to pay for the electricity delivered by the generator falls upon the licensed supplier with the corporate only paying any differential pricing agreed as part of the pricing mechanism.

Supply agreement provisions

The corporate's electricity supply contract will need to contain the contractual mechanics to allow for the sleeving of power/power prices into the supply contract. We would expect to see robust provisions dealing with the securing and retaining of guarantee of origin certificates (in the UK, REGOs) from the relevant generating station in order to provide a clear audit trail of renewable energy which is to be sleeved into the corporate's supply.

Where pre-existing rights in a supply contract are being "activated" (rather than negotiated afresh) – care should be taken to ensure that the mechanisms are still fit for purpose and provide the certainty and information flows required. This can also be a good time to carry out a general review of the supply contract to ensure that it remains suitable and to audit the arrangements for billing forecasting and pass through charges – to ensure the supply contract is being properly operated.

Keep it simple?

Properly drafted, synthetic PPAs can be used to meet many corporates' requirements in a more streamlined and cost effective manner than through a back-to-back structure. We are not suggesting this is a one-size fits all solution. For some, a back-to-back structure will be more appropriate. However, before implementing a corporate PPA strategy we do suggest that a synthetic PPAs structure is properly considered by customer, licensed supplier and generator to see whether this can provide a more efficient model for the sleeving of electricity supplies.

For more information, please contact Nick Churchward or Ross Fairley.